Indicators on Summitpath Llp You Should Know

Indicators on Summitpath Llp You Should Know

Blog Article

The Greatest Guide To Summitpath Llp

Table of ContentsHow Summitpath Llp can Save You Time, Stress, and Money.The smart Trick of Summitpath Llp That Nobody is Talking AboutOur Summitpath Llp Statements6 Simple Techniques For Summitpath Llp

Most just recently, introduced the CAS 2.0 Method Development Training Program. https://www.awwwards.com/summitp4th/. The multi-step coaching program includes: Pre-coaching positioning Interactive team sessions Roundtable discussions Individualized mentoring Action-oriented mini prepares Companies wanting to expand right into advisory solutions can also transform to Thomson Reuters Technique Ahead. This market-proven technique offers material, tools, and advice for firms curious about consultatory solutionsWhile the modifications have actually unlocked a number of development possibilities, they have actually likewise resulted in difficulties and concerns that today's firms require to carry their radars. While there's difference from firm-to-firm, there is a string of common challenges and concerns that tend to run sector wide. These include, yet are not limited to: To remain competitive in today's ever-changing regulative setting, companies need to have the capability to promptly and successfully conduct tax obligation research study and improve tax obligation coverage performances.

Furthermore, the new disclosures may cause a rise in non-GAAP actions, traditionally a matter that is very inspected by the SEC." Accountants have a lot on their plate from regulative modifications, to reimagined service designs, to an increase in client assumptions. Equaling all of it can be difficult, however it doesn't have to be.

Some Known Details About Summitpath Llp

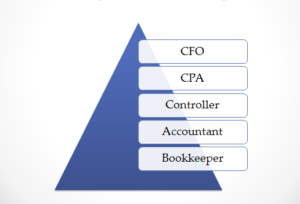

Below, we explain four CPA specialties: taxation, management accountancy, monetary reporting, and forensic bookkeeping. CPAs specializing in taxation assist their customers prepare and file income tax return, lower their tax burden, and prevent making mistakes that might lead to pricey penalties. All Certified public accountants need some expertise of tax obligation legislation, however focusing on taxation means this will certainly be the focus of your work.

Forensic accountants normally begin as general accounting professionals and relocate into forensic audit roles gradually. They need strong logical, investigatory, organization, and technological accountancy abilities. CPAs that focus on forensic accounting can often go up into management bookkeeping. CPAs need a minimum of a bachelor's level in bookkeeping or a similar area, and they must complete 150 debt hours, including accountancy and organization courses.

No states need a graduate level in bookkeeping., auditing, and taxation.

And I liked that there are whole lots of various task alternatives which I would not be jobless after graduation. Bookkeeping additionally makes practical feeling to me; it's not simply academic. I such as that the debits always have to equate to the credits, and the annual report needs to stabilize. The certified public accountant is an important credential to me, and I still obtain continuing education and learning credit histories each year to stay on top of our state needs.

Getting My Summitpath Llp To Work

As a self-employed professional, I still use all the standard structure blocks of accounting that I found out in college, seeking my certified public accountant, and working in public audit. One of the things I truly like regarding bookkeeping is that there are various tasks offered. I determined that I intended to start my profession in public bookkeeping in order to discover a whole lot in a short amount of time and be exposed to various types of customers and various locations of accountancy.

"There are some offices that do not wish to consider someone for an accountancy function who is not a CERTIFIED PUBLIC ACCOUNTANT." Jeanie Gorlovsky-Schepp, CPA A CPA is an extremely beneficial credential, and I intended to position myself well in the market for numerous jobs - affordable accounting firm. I made a decision in university as a bookkeeping major that I intended to try to obtain my CPA as quickly as I could

I have actually satisfied a lot of excellent accountants that don't have a CPA, yet in my experience, having the credential actually assists to market your know-how and makes a difference in your compensation and profession alternatives. There are some work environments that don't want to take into consideration somebody for an accounting duty that is not a CERTIFIED PUBLIC ACCOUNTANT.

Summitpath Llp Can Be Fun For Anyone

I truly enjoyed working on different kinds of projects with various customers. In 2021, I decided to take the next step in my bookkeeping occupation trip, and I am currently a freelance audit specialist and organization advisor.

It remains to be a growth location for me. One essential high quality in being an effective certified public accountant is genuinely respecting your customers and their services. I love dealing with not-for-profit customers for that very factor I feel like I'm really adding to their goal by helping them have great financial information on which to make wise organization choices.

Report this page